Creating a small business market research survey questionnaire is one of the most powerful steps you can take to understand your customers, reduce risks, and identify opportunities for growth. Unlike assumptions or guesswork, a well-structured questionnaire gathers direct feedback from your target audience, giving you insights into their needs, preferences, and buying behaviors. Whether you are a startup preparing for a new product launch or an established company exploring expansion, a market research survey questionnaire provides the clarity you need to make evidence-based decisions.

In today’s competitive environment, knowing what your customers think is no longer optional—it’s essential. A questionnaire designed with clear objectives and unbiased questions helps you measure demand, test pricing strategies, evaluate brand awareness, and understand customer satisfaction. Throughout this guide, we’ll explore what a market research survey questionnaire is, how to create one effectively, and how to use the results to strengthen your business. We’ll also look at examples, tools, localization strategies, and best practices to avoid common pitfalls so you can maximize the impact of your research.

What Is a Market Research Survey Questionnaire?

A market research survey questionnaire is a structured set of questions designed to collect valuable information from customers or potential customers. Unlike casual polls, a questionnaire has specific research objectives—it is carefully designed to capture accurate data on preferences, behaviors, and perceptions. Businesses use these surveys to make strategic decisions about product development, service improvements, branding, pricing, and market positioning.

For instance, a clothing retailer may distribute a market research survey to discover which styles, fabrics, or price ranges appeal to their audience. By analyzing these responses, the business can adjust inventory and create marketing campaigns that resonate with real customer preferences.

So, what is a market research survey questionnaire in practice? It’s a versatile tool. It can measure brand awareness, track customer satisfaction, or test interest in a new product idea. Companies rely on platforms such as SurveyMonkey, Qualtrics, and Typeform to create questionnaires that are engaging and accessible to respondents.

A successful questionnaire is designed with a clear purpose, includes a balance of open and closed ended questions, and avoids biased wording. By transforming customer voices into data, the questionnaire reduces uncertainty and empowers businesses with evidence they can act on. This is why learning how to create a market research survey questionnaire is one of the most impactful skills for any small business.

How to Create a Market Research Survey Questionnaire

Designing a strong market research survey questionnaire requires thoughtful planning and execution. The process begins with defining clear objectives. Ask yourself what you want to learn: Are you testing a new product? Measuring customer satisfaction? Or analyzing purchasing behaviors? These goals shape every question you include.

Next, identify your target audience. Your respondents might be loyal customers, potential buyers, or specific demographic groups. A clearly defined audience ensures the responses are relevant and reliable.

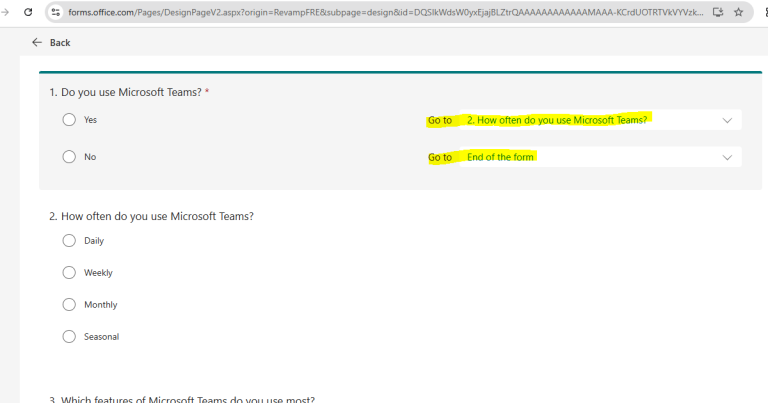

Once you know your goals and audience, focus on writing clear, concise questions. Avoid vague or leading wording. A mix of multiple-choice, Likert scale, and open-ended questions provides both measurable data and rich insights. Many businesses turn to market research survey templates, which offer pre-designed structures that can be customized for specific needs.

Before launch, always test your questionnaire with a small pilot group. This step uncovers unclear wording or technical issues that could harm the quality of your data. After refinement, distribute the survey through channels where your target audience is most active, such as email campaigns, LinkedIn groups, or online customer panels.

Finally, carefully analyze your results. Use built-in analytics from survey platforms or export data into tools like SPSS or Excel for deeper analysis. The insights you extract will help you take data-driven actions, whether that’s refining a product or reshaping a marketing strategy. Learning how to do a market research survey questionnaire effectively transforms raw responses into decisions that strengthen your business.

How to Do a Market Research Survey Effectively

Knowing how to do a market research survey effectively is different from simply creating one. The quality of execution determines whether your insights are meaningful. Timing plays an important role. For instance, customer satisfaction surveys yield the best results when distributed immediately after a purchase or service experience, when impressions are still fresh.

Choosing the right distribution method is equally critical. Online distribution is the most common, but certain demographics may respond better to phone or in-person surveys. For wider reach, businesses often combine channels. Offering incentives—such as discounts or gift cards—can increase participation rates, but they must be balanced to avoid introducing bias.

Anonymity and confidentiality encourage honest responses, especially when questions touch on sensitive topics. Communicate how data will be used and ensure compliance with privacy laws like GDPR. Modern market research survey tools allow businesses to monitor progress in real-time, adjusting outreach strategies if response rates are low.

Finally, validate your data. Not all responses are reliable—watch for incomplete submissions or patterned answers. Cleaning the dataset ensures your conclusions are based on high-quality information. By approaching survey execution with care, you maximize the credibility of your findings and build a foundation for better decisions.

Market Research Survey Questionnaire Examples

Studying market research survey examples can help businesses see how questionnaires function in different contexts.

Customer satisfaction surveys are among the most widely used. A retail company may ask: “How satisfied are you with your recent purchase?” Such responses highlight service strengths and weaknesses.

Product feedback surveys are especially useful in technology and consumer goods. When launching a new app, a company might include questions like: “Which feature do you find most useful?” or “What improvements would you suggest?” This feedback helps prioritize product development.

Brand awareness surveys assess recognition in the market. A sportswear company could ask: “When you think of athletic shoes, which brands come to mind?” The results measure brand positioning against competitors.

Startups often rely on market demand surveys before investing heavily in product development. They may ask: “How likely are you to purchase a product like this?”

Finally, B2B organizations use employee or vendor-focused surveys to evaluate decision-making factors like pricing, service quality, or reliability.

These market research survey questionnaire examples demonstrate the versatility of surveys in uncovering insights across industries. They show how businesses can align questions with goals to capture data that directly informs strategy.

Market Research Survey for New Product Launches

Launching a new product is risky, and a market research survey for new product development is essential to minimize uncertainty. Surveys at different stages provide valuable guidance.

Pre-launch surveys assess market need. A company may ask: “Would you consider buying this product at $50?” or “What problem does this product solve for you?” Such feedback helps refine the product before heavy investments are made.

Feature preference surveys identify which attributes matter most. For example, a smartphone manufacturer might ask: “Which is more important to you—camera quality or battery life?” This allows them to prioritize engineering resources.

Price sensitivity surveys, such as those using Van Westendorp’s Price Sensitivity Meter, reveal the acceptable price range customers are willing to pay.

After launch, post-launch surveys measure adoption and satisfaction. Questions like “How often do you use the product?” or “What improvements would you like to see?” help track success and identify areas for iteration.

By integrating a market research survey questionnaire at each stage of the product lifecycle, businesses reduce risk, ensure alignment with customer expectations, and increase the likelihood of a successful launch.

Market Research Survey Tools

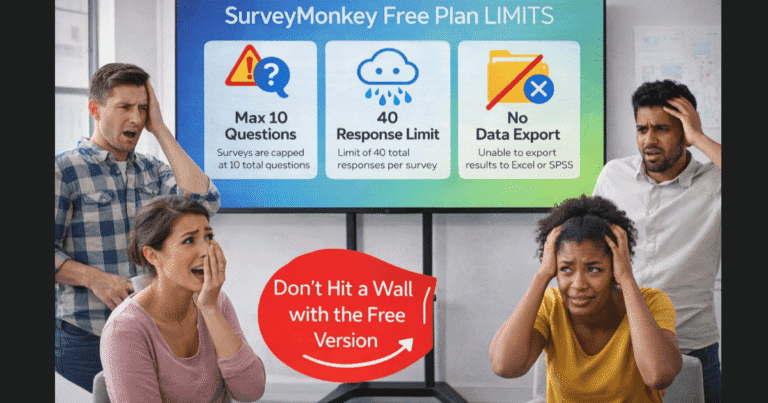

The success of a questionnaire depends not only on its design but also on the platform used to deliver it. Leading market research survey tools offer features that make the process easier and more effective.

SurveyMonkey remains a popular choice for its intuitive interface and ready-made templates tailored to business research. Qualtrics offers advanced analytics and is favored by enterprises requiring robust features like conjoint analysis and segmentation. Typeform is known for its interactive, conversational design that keeps respondents engaged. Google Forms provides a free and accessible solution for small businesses, while QuestionPro is designed to handle large-scale surveys with advanced reporting capabilities.

When choosing a tool, businesses should consider ease of use for both researchers and respondents, compatibility with CRM or marketing software, data export options for analysis, and compliance with data protection regulations. A reliable tool ensures accurate data collection, reduces technical barriers, and empowers businesses to focus on analysis rather than logistics.

By selecting the right tool, you streamline your entire research process and enhance the quality of your insights.

How to Localize Market Research Surveys

When expanding globally, businesses must know how to localize market research surveys to account for cultural and linguistic differences. Direct translations often fall short, as meaning can shift across languages. Professional localization ensures questions retain their intended meaning while remaining culturally appropriate.

Cultural sensitivity is critical. Topics like income or personal lifestyle may be considered intrusive in certain regions. Consulting local experts helps you adapt wording while maintaining accuracy. Distribution methods also vary by region. For instance, WeChat may work in China, while WhatsApp or Facebook groups are better for Latin America.

Even response formats may need adjustment. A Likert scale of 1–5 might not be universally understood. Adapting scale labels for clarity across languages improves data quality. Additionally, compliance with local regulations such as GDPR in Europe or PDPA in Singapore ensures ethical handling of personal information.

Localization ensures that your market research survey questionnaire produces valid, reliable, and respectful insights across cultures. Without it, businesses risk misinterpreting results or offending respondents, leading to poor decisions and reputational damage.

How to Avoid Common Pitfalls of Online Market Research Surveys

Conducting surveys online offers speed and reach but comes with risks. One of the biggest pitfalls is sampling error. If your market research survey questionnaire does not reach the right audience, the data becomes unreliable. Always define your target respondents carefully.

Low response rates are another challenge. Long or poorly designed surveys discourage participation. Keeping questionnaires concise and offering incentives like small discounts can boost completion.

Poorly worded questions also lead to flawed data. Leading or ambiguous wording creates bias, making responses less trustworthy. Pilot testing helps uncover these issues before launch.

Mobile accessibility is another common oversight. Many respondents complete surveys on their phones, so questionnaires must be optimized for mobile devices. Ignoring this can alienate large portions of your audience.

Finally, failing to clean data can lead to inaccurate conclusions. Straight-lining (choosing the same answer repeatedly) or incomplete responses should be filtered out. By addressing these pitfalls, businesses ensure that their online market research surveys produce insights that can truly support decision-making.

How Do Surveys Help to Support Certain Types of Market Research?

Surveys play a unique role in supporting different types of research approaches. In exploratory research, a market research survey questionnaire provides initial insights when businesses are evaluating new ideas. This stage often focuses on broad, open-ended questions that capture attitudes and emerging trends.

Descriptive research uses surveys to map out customer demographics, satisfaction levels, or buying behaviors. By capturing this snapshot, businesses gain a clear picture of their market.

Causal research relies on surveys to test cause-and-effect relationships. For example, “If we lower the price by 10%, how likely are you to purchase?” Responses to such questions provide data that supports experimental design.

Tracking studies use surveys conducted over time to measure changes in customer perceptions or brand awareness. These long-term projects reveal how consumer attitudes evolve and whether business strategies are working.

By aligning questionnaires with research type, businesses make the most of surveys as versatile tools that support multiple forms of market research.

Best Practices for Writing Market Research Survey Questions

Writing effective questions is the foundation of a strong market research survey questionnaire. Poorly designed questions lead to misleading data. Start by keeping questions clear and simple—avoid jargon or technical terms that respondents may not understand.

Questions should also be unbiased. For example, instead of asking “How much did you enjoy our excellent customer service?” use neutral phrasing such as “How would you rate your customer service experience?” Neutrality prevents skewed responses.

Mixing question types enhances the quality of data. Closed-ended questions like multiple choice or rating scales provide measurable data, while open-ended questions capture richer feedback. Balance is key.

It’s also important to consider order effects. Placing sensitive questions at the beginning may discourage participation. Instead, start with easier, general questions and gradually progress to more specific or personal topics.

Finally, pilot testing is invaluable. Testing your survey with a small group highlights confusing wording and ensures your questions capture the data you actually need. By following these best practices, businesses can craft survey questions that yield accurate, actionable insights.

How to Analyze and Interpret Market Research Survey Questionnaire Results

Collecting responses is only half the journey—analysis turns raw data into insights. Start by cleaning the dataset, removing incomplete or unreliable responses. Next, use descriptive statistics to summarize data. Measures like mean, median, and frequency distributions reveal patterns at a glance.

Cross-tabulation helps identify relationships between variables. For example, analyzing satisfaction scores by age group or location can uncover demographic patterns. For more advanced studies, businesses often use regression or factor analysis to identify drivers of customer behavior.

Qualitative responses from open-ended questions should not be ignored. Coding these responses into themes provides context that numbers alone cannot capture.

Visualization tools like charts and dashboards make results easier to interpret and communicate to stakeholders. Clear visualizations turn complex data into accessible stories.

Ultimately, interpreting survey results requires aligning findings with research objectives. By asking, “What decisions can we make based on this data?” businesses ensure their analysis leads to actionable outcomes rather than just descriptive reports.

Using Incentives to Improve Market Research Survey Participation

Encouraging participation in surveys can be challenging, especially online. Offering incentives is one proven way to improve response rates. Incentives range from monetary rewards like gift cards to non-monetary benefits such as access to exclusive content or early product trials.

However, incentives must be used carefully. Overly generous rewards may attract people who complete the survey only for the reward, introducing bias. On the other hand, small but meaningful incentives, such as discounts or loyalty points, often strike the right balance.

Transparency is critical. Communicate clearly what the incentive is and how respondents will receive it. Delivering rewards promptly builds trust and encourages future participation.

Incentives should also align with your audience. For example, B2B respondents may prefer access to research findings, while consumer audiences might appreciate vouchers or discounts.

When applied strategically, incentives boost engagement while maintaining data quality. This ensures your market research survey questionnaire collects the responses you need to make reliable business decisions.

The Role of Online Panels in Market Research Surveys

Online panels have become a popular method for distributing surveys, especially when businesses need targeted respondents quickly. An online panel is a pre-recruited group of individuals who agree to participate in surveys in exchange for small rewards or recognition.

The benefit of panels is their ability to provide access to specific demographics. For instance, if you need responses from tech-savvy millennials or healthcare professionals, online panels can deliver participants who meet those criteria.

Panels also speed up data collection. Instead of waiting weeks for organic responses, businesses can gather hundreds of responses in just a few days. Many platforms offering market research survey tools now include panel access as part of their services.

However, it’s important to monitor quality. Some panelists may rush through surveys to earn rewards, so implementing quality checks is essential. Screening questions, attention checks, and time-tracking help ensure the data remains reliable.

By integrating online panels into your survey strategy, you can reach targeted audiences efficiently and improve the robustness of your research.

Conclusion

A small business market research survey questionnaire is more than a list of questions—it’s a strategic tool that transforms customer voices into actionable insights. From understanding what a market research survey is, to learning how to create, distribute, and analyze one effectively, the process requires careful planning and execution.

We’ve explored examples across industries, seen how surveys support new product launches, and identified the best tools for data collection. We also discussed how to localize surveys for international markets, avoid common pitfalls, and follow best practices when writing questions. By analyzing results thoroughly and using incentives or online panels, businesses can increase participation and extract deeper insights.

Ultimately, surveys are one of the most versatile and cost-effective forms of research available. For small businesses, they provide clarity in a competitive landscape, reduce the risk of failure, and guide smarter decisions.

If you’re ready to design your own market research survey questionnaire, our team at My Survey Help can support you in survey design, distribution, and analysis. Request a free quote today and turn your survey data into strategies for success.