Events are one of the most effective ways to connect with audiences, whether they are conferences, workshops, entertainment shows, or corporate training sessions. But no matter how much effort goes into planning, the true measure of success comes from participants themselves. That’s where the event feedback survey comes in. Collecting structured feedback ensures that organizers move beyond guesswork to capture real attendee experiences.

With the right survey strategy, you can identify what worked, pinpoint areas of improvement, and guide the design of future events. From crafting effective event feedback survey questions to analyzing pre and post event data in SPSS, surveys offer valuable insights at every stage. This article explores how to create effective surveys, different question types, analysis strategies, and even advanced methods like running paired t tests in SPSS.

By the end, you’ll know exactly how to design surveys, analyze results, and make evidence-based improvements for your next event.

Crafting Effective Event Feedback Survey Questions

The foundation of any strong feedback instrument lies in carefully chosen event feedback survey questions. These questions should be clear, unbiased, and directly tied to the goals of the event. For example, if you hosted a leadership workshop, you might ask whether attendees gained actionable skills. In contrast, an entertainment event feedback survey might focus more on satisfaction with the performance, venue, or ticketing process.

Good survey design involves a mix of quantitative and qualitative items. Quantitative questions—such as rating scales—allow for easy statistical analysis, while open-ended questions uncover richer insights. Pre event survey questions might include expectations about speakers or preferred topics, while post event survey questions focus on satisfaction levels and takeaways.

To get started, organizers often rely on platforms like Google Forms or SurveyMonkey, both of which offer customizable templates. For nonprofits or community organizations, community surveys provide a solid foundation for building event-related items. Regardless of the tool, the golden rule remains: ask only what you need to know, and design every question with the analysis in mind.

The Role of Virtual Event Feedback Surveys

In today’s digital era, the rise of virtual gatherings has made the virtual event feedback survey more important than ever. Whether it’s a webinar, online training, or digital product launch, virtual events create unique engagement challenges. Attendees may log in from different time zones, face connectivity issues, or multitask during sessions. Capturing their feedback requires a survey tailored for the online environment.

Effective virtual surveys ask about the clarity of audio and visuals, ease of accessing event links, and the effectiveness of interactive tools like polls or breakout rooms. These questions ensure organizers understand how the format influenced attendee experiences. In addition, because virtual attendees often face survey fatigue, shorter, well-structured surveys tend to achieve higher completion rates.

Integrating these surveys with platforms like Zoom or Microsoft Teams can streamline distribution. Sending an event feedback survey email immediately after the session increases the chances of collecting accurate, timely responses. Organizers can then compare these findings with in-person events to determine where digital formats excel or fall short.

Designing an Event Feedback Survey Email Strategy

Even the best survey won’t provide value if people don’t respond. That’s why the event feedback survey email is a critical step in the process. A poorly timed or poorly written email can reduce response rates dramatically.

Best practices suggest sending the email within 24 hours of the event, while memories are still fresh. Personalizing the message—by including the attendee’s name and referencing specific sessions—can make it feel less like mass communication. Adding an incentive, such as a certificate of attendance or entry into a raffle, can also boost response rates.

The subject line plays a huge role in open rates. Lines like “We’d love your feedback on yesterday’s event” or “Help us improve future events in just 2 minutes” typically outperform generic messages. Finally, keep the survey link clear and visible, ideally with a button rather than a text hyperlink.

For corporate or institutional events, automated survey distribution through platforms like Qualtrics or SurveyMonkey ensures consistency. For nonprofits, low-cost tools like Google Forms may be more practical. Regardless of platform, your email should emphasize that feedback is valued and will be used to improve future events.

Entertainment Event Feedback Surveys

Entertainment events—such as concerts, theater performances, or community festivals—require specialized approaches to feedback collection. An entertainment event feedback survey must account for diverse attendees, ranging from families to solo participants.

Survey questions for these events typically focus on the quality of performances, accessibility of the venue, ticketing process, safety, and overall atmosphere. For example, asking “How satisfied were you with the seating arrangements?” provides actionable data for venue organizers. Similarly, asking about pre-show communications or parking availability can highlight logistical issues often overlooked.

One challenge in entertainment events is balancing brevity with depth. Audiences may be less inclined to complete long surveys after a fun evening, so concise surveys with a mix of rating scales and one or two open-ended questions often yield the best results.

Entertainment organizations also benefit from segmenting their data. Families might prioritize safety and convenience, while younger audiences might care more about sound quality and artist lineup. Analyzing results by demographics helps organizers tailor experiences for different audience groups.

How to Create an Event Feedback Survey

When it comes to how to create an event feedback survey, clarity and structure are everything. First, define the goals: do you want to evaluate logistics, content, or attendee satisfaction? Once clear goals are set, select a platform that meets your needs—ranging from free tools like Google Forms to advanced systems like Qualtrics.

Begin by drafting pre event survey questions that set expectations. These might ask what attendees hope to gain, which sessions interest them most, or any accessibility needs. During or after the event, follow up with post event survey questions to measure satisfaction, learning outcomes, and overall impressions.

Visual design also matters. Surveys should be mobile-friendly, especially since many respondents will answer on their phones. Use progress bars, logical flow, and skip patterns to make the experience seamless. Finally, always pilot-test your survey with a small group before full distribution.

For those seeking professional assistance, My Survey Help provides expert support in designing surveys tailored to your event goals. This ensures your survey is not only functional but also aligned with your data analysis needs.

Event Feedback Survey Analysis and Reporting

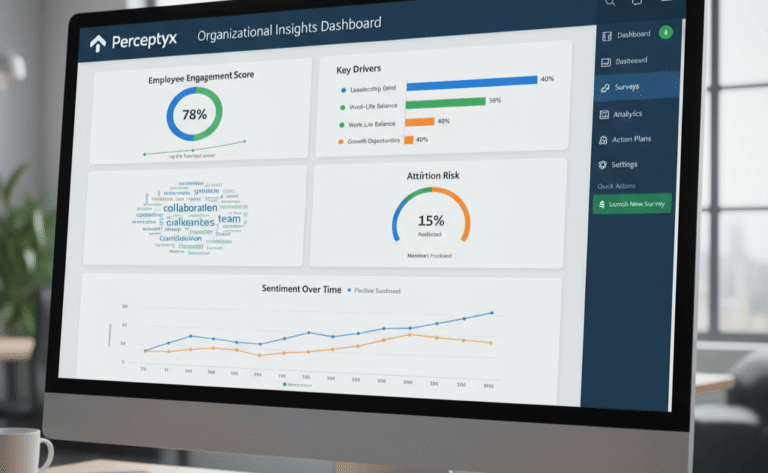

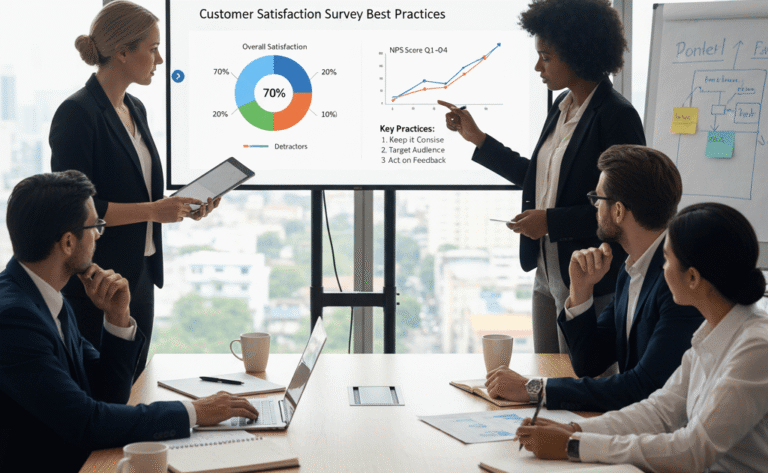

Collecting responses is only the beginning. Event feedback survey analysis and reporting transforms raw data into actionable insights. Organizers should begin by analyzing overall satisfaction scores and identifying patterns in open-ended comments.

Visualizations—such as charts and heatmaps—make it easier to communicate results to stakeholders. Segmenting results by demographics, ticket type, or session can uncover insights that broad averages might hide. For example, first-time attendees might have different experiences than returning participants.

Advanced analysis involves comparing pre and post event data to measure knowledge gains or satisfaction changes. Tools like SPSS, R, or Excel allow researchers to test whether changes are statistically significant. Reporting should focus on clarity and actionability. Long technical documents may not engage stakeholders, but concise executive summaries paired with data visualizations often do.

For in-depth help with complex reporting, resources like Survey Data Analysis offer step-by-step guidance on cleaning, analyzing, and presenting survey findings.

Comparing Pre and Post Event Data

Comparing pre and post event responses is one of the most powerful ways to measure impact. Pre event survey questions set a baseline for attendee expectations or knowledge levels, while post event survey questions assess outcomes.

For example, a professional training session might ask before the event, “How confident are you in applying data analysis techniques?” The post event survey could then ask the same question, allowing direct comparison of confidence levels. This method works not just for training events but also for conferences, webinars, and entertainment events where expectations differ from outcomes.

The challenge lies in ensuring that pre and post questions align. If the questions aren’t matched properly, comparisons lose their meaning. Analyzing these paired results requires statistical methods like paired t tests in SPSS. By comparing the mean differences before and after the event, organizers can determine whether changes are statistically significant.

When done well, comparing pre and post event data goes beyond measuring satisfaction—it demonstrates learning, engagement, and overall event effectiveness.

How to Analyze Pre and Post Event Survey Data

When organizers ask how to analyze pre and post event survey data, the answer lies in choosing the right tools and methods. The first step is ensuring data cleanliness: responses must be matched by individual to make accurate before-and-after comparisons. Next, descriptive statistics provide an overview of changes.

SPSS is particularly effective for these analyses. It allows you to calculate means, standard deviations, and run tests of significance. For example, if your pre event survey asked about confidence levels and your post event survey repeated the same question, SPSS can test whether the increase in scores is statistically meaningful.

Visualization is equally important. Side-by-side bar charts or line graphs help stakeholders see changes at a glance. While Excel can handle basic tasks, specialized software like SPSS offers more robust statistical tools. For those less comfortable with statistics, working with experts ensures accurate analysis and interpretation.

Advanced SPSS Analysis: Paired t Tests for Event Surveys

For organizers wondering how to analyze pre and post event survey in SPSS, one of the most widely used methods is the paired t test. This test compares two sets of responses from the same group of individuals to see whether there is a statistically significant difference.

The process begins with cleaning the dataset and ensuring pre and post responses are correctly paired. Next, you can run a paired t test in SPSS for pre and post event survey responses to calculate whether observed differences are due to chance or reflect a meaningful shift. For example, if knowledge scores rose significantly after a training event, the t test confirms this improvement.

The final step involves interpretation. Understanding how to interpret a paired t test for event survey in SPSS is critical. A significant result suggests your event produced measurable change, while a non-significant result may indicate that outcomes were not as impactful as hoped.

For those who need guidance, My Survey Help provides online SPSS help including step-by-step tutorials and expert support for running advanced analyses. Whether you want to pay someone to do SPSS analysis or simply need coaching, expert help ensures your results are accurate and credible.

Increasing Response Rates for Event Surveys

High response rates are essential for reliable data. Without sufficient responses, survey results may not accurately represent attendee sentiment. Several strategies can help maximize participation.

First, timing is crucial. Distributing the survey immediately after the event capitalizes on fresh memories and emotions. Embedding QR codes at the venue or sharing links during closing remarks increases accessibility.

Second, incentives often boost response rates. Offering discounts, exclusive access to recordings, or entry into a prize draw can motivate participants to complete the survey. Transparency about how feedback will be used further strengthens trust.

Third, personalization matters. Emails that address attendees by name and reference the specific event they attended feel more engaging than generic messages.

Finally, optimizing surveys for mobile devices ensures accessibility for a wider audience. Many participants complete surveys on their phones, so ensuring a seamless experience can significantly improve completion rates.

By adopting these strategies, event organizers not only increase response rates but also ensure that the feedback they collect is representative and actionable.

Using Event Feedback to Drive Sponsorship Value

Sponsors are an integral part of many events, and demonstrating return on investment (ROI) is key to securing long-term partnerships. Event feedback surveys can provide the data needed to showcase sponsor value.

Questions can assess sponsor visibility, attendee engagement with sponsor activities, and perceived relevance of sponsored content. For example, asking “How did you rate the sponsor booths?” or “Did sponsor activities add value to your experience?” provides measurable insights.

Organizers can then package these results into sponsor reports, highlighting metrics such as brand awareness, engagement rates, and attendee sentiment. This data-driven approach helps sponsors see the tangible benefits of their investment.

Event feedback surveys also allow sponsors to suggest improvements. Including sponsors in the feedback loop strengthens relationships and ensures that future collaborations are mutually beneficial.

By leveraging survey insights, organizers not only improve the attendee experience but also build stronger partnerships with sponsors. This dual benefit ensures that events remain sustainable and impactful.

Real-World Event Feedback Survey Examples

Examples provide clarity and inspiration for designing effective surveys. Corporate conferences often use feedback surveys to evaluate speaker quality, networking opportunities, and logistical arrangements. Universities rely on event surveys to assess student workshops, career fairs, and academic conferences. Entertainment organizers collect feedback on performances, venue facilities, and overall atmosphere.

For instance, a corporate training session might include pre-event surveys to capture participant goals and post-event surveys to measure knowledge gained. Comparing results demonstrates the training’s effectiveness and provides evidence for future program funding.

Similarly, a music festival organizer might use post-event surveys to evaluate crowd management, safety, and satisfaction with performers. These insights directly inform future planning and marketing strategies.

Real-world examples highlight the versatility of event feedback surveys and show how they can be adapted across industries. For more case studies and examples, see community surveys and customer feedback surveys.

Conclusion

Event feedback surveys are more than a formality—they are essential tools for measuring success, identifying improvements, and showcasing impact. From event feedback survey questions to advanced SPSS analysis, each step in the process contributes to stronger, more data-driven decision-making.

Virtual event feedback surveys capture online attendee experiences, while entertainment event feedback surveys help fine-tune live performances. Well-crafted event feedback survey emails boost participation rates, while careful comparison of pre and post event survey questions reveals measurable changes. Advanced methods like running paired t tests in SPSS help organizers validate outcomes with confidence.

Whether you are planning a corporate training, a community workshop, or a live concert, the path to improvement lies in thoughtful survey design and rigorous analysis. And if you need expert guidance, My Survey Help ensures your event surveys are not only well-structured but also fully optimized for actionable insights. By embracing the full survey process, you can transform events into unforgettable experiences backed by evidence.